One of the most helpful initiatives for new residents is the New Immigrant Mortgage Program, which offers a practical pathway to homeownership in Canada. Canada is known for being welcoming to immigrants and continuously improving settlement opportunities for newcomers.

For many immigrants, buying a home in a new country can feel overwhelming due to unfamiliar financial systems, credit requirements, and housing rules. This program is designed to reduce those barriers and support newcomers in building a stable and secure future.

In this guide, we explore how the program works, who is eligible, its benefits, and how you can apply.

What Is Canada’s New Immigrant Mortgage Program?

The New Immigrant Mortgage Program is a specialized mortgage option created to help newcomers and recent permanent residents purchase a home in Canada, even if they lack a Canadian credit history.

The program addresses common challenges faced by immigrants when applying for traditional mortgages and provides flexible, newcomer-friendly solutions.

Key Features of the Program

Government Support and Partnerships

Many lenders offering this program collaborate with government agencies and nonprofit settlement organizations. These partnerships increase accessibility and provide additional guidance and resources for newcomers.

Variety of Property Options

Eligible properties often include:

Single-family homes

Townhouses

Condominiums

Multi-unit residential properties

This flexibility allows newcomers to choose housing that best fits their lifestyle and budget.

Alternative Credit Assessment

Since many immigrants do not yet have Canadian credit histories, lenders may assess creditworthiness using:

Rental payment history

Utility bill records

Credit reports from the home country

Other proof of financial responsibility

Language Support

Many participating lenders offer services in multiple languages to ensure borrowers fully understand mortgage terms and conditions.

Mortgage Insurance Options

If the down payment is less than 20%, mortgage insurance is usually required. Borrowers may qualify for insurance through CMHC or private insurers under this program.

Financial Literacy Support

Some lenders provide workshops and educational sessions covering:

Budgeting and financial planning

Mortgage terms and repayment

Debt management

Long-term financial stability

Joint Applications and Co-Signers

Applicants who do not meet all requirements independently may apply with a Canadian co-signer, improving approval chances.

Home Equity Growth

Regular mortgage payments allow newcomers to build home equity, contributing to long-term financial security and future investment opportunities.

Settlement Services

Certain lenders include settlement services such as:

Housing assistance

Community connections

Information on schools, employment, and healthcare

Support for Permanent Residency Goals

Homeownership demonstrates financial stability and long-term commitment to Canada, which may strengthen future immigration or PR applications.

Eligibility Requirements

To qualify for the New Immigrant Mortgage Program, applicants typically must meet the following criteria:

Be a new immigrant or permanent resident, usually within the last five years

Provide proof of income (pay stubs, employment contracts, or business income)

Submit valid immigration documents and identification

Show credit history, either from Canada or their home country

Benefits of the New Immigrant Mortgage Program

Lower down payment options, sometimes as low as 5%

No Canadian credit history required

Flexible mortgage terms, including fixed or variable rates

Personalized guidance throughout the mortgage process

Education and ongoing support for first-time homeowners

How to Apply

Step 1: Contact Participating Lenders

Reach out to banks or lenders that offer the New Immigrant Mortgage Program. They understand newcomer needs and eligibility requirements.

Step 2: Gather Required Documents

Prepare documents such as:

Proof of income

Identification

Immigration status documents

Credit history (if available)

Step 3: Submit Your Application

Once documentation is complete, submit your mortgage application. The lender will review it and determine eligibility.

Important Considerations

Before applying, keep the following in mind:

Carefully review interest rates, repayment terms, and conditions

Ensure the mortgage aligns with your financial goals

Consider consulting a mortgage broker or financial advisor if unfamiliar with the Canadian housing market

Conclusion

The New Immigrant Mortgage Program reflects Canada’s commitment to inclusion and equal opportunity. By addressing the unique challenges faced by newcomers, the program makes homeownership achievable and supports long-term settlement and community building.

More than just a financing option, this program helps immigrants establish roots, build wealth, and contribute to Canada’s diverse communities. With flexible requirements, professional guidance, and strong institutional support, it brings the dream of owning a home in Canada closer to reality.

Frequently Asked Questions (FAQs)

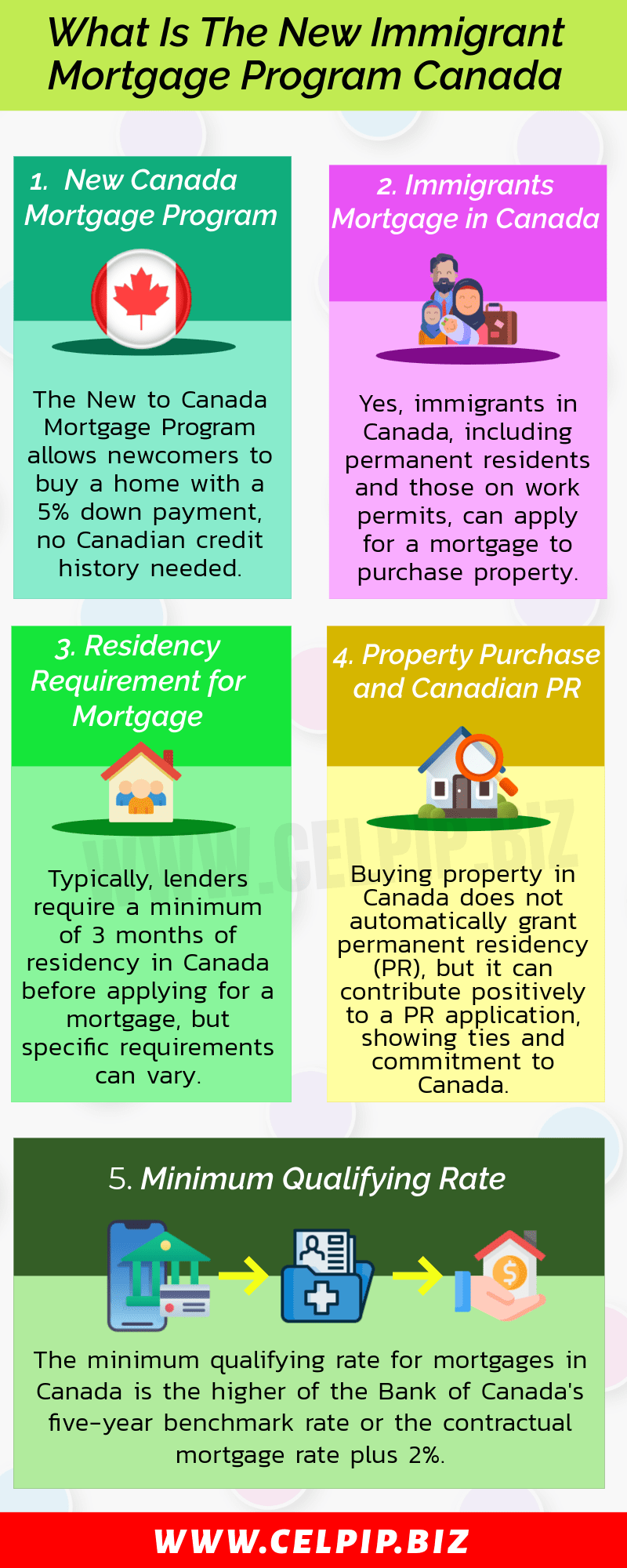

What is the New Immigrant Mortgage Program in Canada?

It is a mortgage program that allows newcomers to buy a home with as little as a 5% down payment and without a Canadian credit history.

Can immigrants get a mortgage in Canada?

Yes, Permanent residents and some work permit holders can qualify for mortgages through newcomer programs.

How long must I live in Canada before applying?

Many lenders require at least three months of residence, though requirements may vary.

Does buying property in Canada give PR?

No, property ownership does not automatically grant PR, but it may support your immigration profile.

What is the lowest mortgage interest rate in Canada?

The minimum qualifying rate is either the Bank of Canada’s benchmark rate or the contract rate plus 2%.

What are current mortgage rates in Canada?

Rates vary by lender and mortgage type. Five-year fixed mortgage rates are typically around 2%–3%, depending on market conditions.