In an era where travel opens the door to endless adventure and discovery, feeling safe and protected is essential. For US citizens planning a trip to Canada a country known for its breathtaking landscapes, vibrant cities, and rich cultural heritage travel insurance plays a vital role.

A new generation of travel insurance plans is designed to meet the evolving needs of modern travellers, offering security and peace of mind throughout the journey. This article explains why travel insurance is important for Americans visiting Canada and highlights the key features and benefits of policies tailored specifically for them.

Travel Insurance for Americans in Canada

Travel insurance acts as a financial and emotional safety net, protecting travellers from unexpected situations that may arise during their trip. Policies designed for US citizens travelling to Canada typically cover a wide range of risks, ensuring travellers are prepared for the unexpected.

Medical Coverage: A Top Priority

Medical coverage is often the most critical component of travel insurance. While Canada has a strong healthcare system, it does not provide free medical care to visitors. Without insurance, medical treatment, hospitalisation, or emergency services can become extremely expensive.

Travel insurance helps reduce this financial burden by covering:

Emergency medical treatment

Hospital stays

Prescription medication

Emergency medical evacuation, if required

This ensures travellers receive proper care without worrying about overwhelming costs.

Trip Cancellation and Interruption Protection

Beyond medical emergencies, travel insurance also covers trip cancellation and interruption. This benefit reimburses travellers for non-refundable, prepaid expenses if they must cancel or shorten their trip due to covered reasons such as:

Illness or injury

Family emergencies

Severe weather conditions

Many policies also include trip delay coverage, which compensates for additional expenses like meals and accommodation caused by unexpected delays.

Coverage for Lost, Stolen, or Damaged Belongings

Another valuable feature of travel insurance is protection for personal belongings. This coverage reimburses travellers if their luggage, electronics, or valuables are lost, stolen, or damaged during the trip, providing financial relief and peace of mind.

Choosing the Right Policy

When selecting travel insurance for a trip to Canada, it’s important to consider the length of stay, planned activities, and personal needs. Many insurers offer flexible policies that can be customised, whether you’re taking a short city break or embarking on a long outdoor adventure.

Ultimately, travel insurance allows US citizens to enjoy Canada with confidence, knowing they are protected against unexpected disruptions.

How to Customise Your Travel Insurance for Canada

Customising your travel insurance ensures your coverage aligns perfectly with your travel plans. Follow these steps to choose the right protection for your Canadian trip:

1. Assess Your Travel Needs

Review your itinerary and identify potential risks. Consider:

Length of your trip

Planned activities

Pre-existing medical conditions

Understanding these factors helps you select appropriate coverage.

2. Choose Comprehensive Coverage

Opt for a policy that includes medical expenses, trip cancellation, trip interruption, and baggage protection. Comprehensive coverage safeguards you against multiple potential issues.

3. Ensure Adequate Medical Coverage

Healthcare coverage should include:

Medical treatment and hospitalisation

Emergency evacuation

Repatriation

Check whether pre-existing conditions are covered and note any exclusions related to high-risk activities.

4. Consider Trip Cancellation and Interruption Benefits

If you have invested significantly in flights, accommodation, or tours, this coverage protects your finances if your plans change unexpectedly.

5. Explore Optional Add-ons

Depending on your travel style, consider additional coverage such as:

Rental car damage

Adventure sports protection

Travel delay compensation

Emergency assistance services

Choose add-ons that match your itinerary.

6. Review Coverage Limits and Deductibles

Examine coverage limits carefully to ensure they are sufficient, especially for medical emergencies. Also, consider whether the deductible amount suits your budget.

7. Read the Policy Carefully

Always review the terms and conditions, including exclusions and documentation requirements. Understanding the fine print helps avoid surprises when making a claim.

8. Seek Professional Advice if Needed

If you’re unsure which policy best suits your needs, consult a travel insurance agent or financial advisor. Professional guidance can help you make an informed decision.

How to Keep US Travellers Safe in Canada

Travelling to Canada can be an exciting and rewarding experience for US citizens. From vibrant cities to breathtaking natural landscapes, Canada offers something for every type of traveller. However, staying safe and prepared is essential to fully enjoy your journey. Along with planning your itinerary, understanding safety measures and securing the right travel insurance can make your trip stress-free.

You may also find it helpful to read about Health Insurance for New Immigrants in Canada to better understand how healthcare coverage works.

Essential Safety Tips for US Travellers in Canada

The following strategies are designed to help US travellers stay safe, reduce risks, and enjoy a smooth travel experience in Canada:

1. Research Your Destination

Before travelling, take time to research your destination thoroughly. Learn about local laws, customs, weather conditions, and any regional safety concerns. Stay updated on travel advisories and understand potential health or environmental risks, especially if you plan to visit remote or wilderness areas.

2. Get Travel Insurance

Travel insurance is one of the most important steps for US travellers visiting Canada. Choose a policy that covers:

Medical emergencies and hospitalisation

Emergency medical evacuation

Trip cancellation or interruption

Lost, stolen, or delayed baggage

Ensure the policy matches your travel plans and provides adequate coverage for the entire duration of your stay.

3. Keep Important Documents Secure

Safeguard essential travel documents such as your passport, visa, insurance policy, and itinerary.

Make digital copies and store them securely online

Carry backup paper or digital copies when sightseeing

Use a travel document organiser or anti-theft pouch for added protection

4. Stay Alert and Use Common Sense

Remain cautious in crowded areas, tourist attractions, and public transport hubs. Avoid displaying valuables openly and be mindful of pickpocketing or scams. Trust your instincts—if a situation feels unsafe, remove yourself from it.

5. Stay Connected

Keep family or friends informed about your travel plans and check in regularly. Consider using international roaming or purchasing a local SIM card so you can stay connected while in Canada.

6. Respect Local Laws and Customs

Familiarise yourself with Canadian laws and cultural norms to avoid unintentional violations. Follow regulations related to alcohol consumption, driving, outdoor activities, and wildlife encounters. Respect local customs and etiquette at all times.

7. Be Prepared for Emergencies

Know how to contact emergency services in Canada:

Police, fire, and ambulance: 911

Locate nearby hospitals or medical facilities in advance

Carry a basic first-aid kit and keep important emergency contact numbers easily accessible.

Why Travel Insurance Matters for US Citizens Visiting Canada

The introduction of travel insurance tailored for US citizens visiting Canada is a major step toward ensuring safer and more comfortable travel. Comprehensive travel insurance protects travellers from a wide range of unexpected situations, including medical emergencies, trip disruptions, and financial losses.

With the right coverage in place, travellers can focus on exploring Canada—whether walking through bustling city streets or venturing into the wilderness—without unnecessary worry.

Frequently Asked Questions (FAQs)

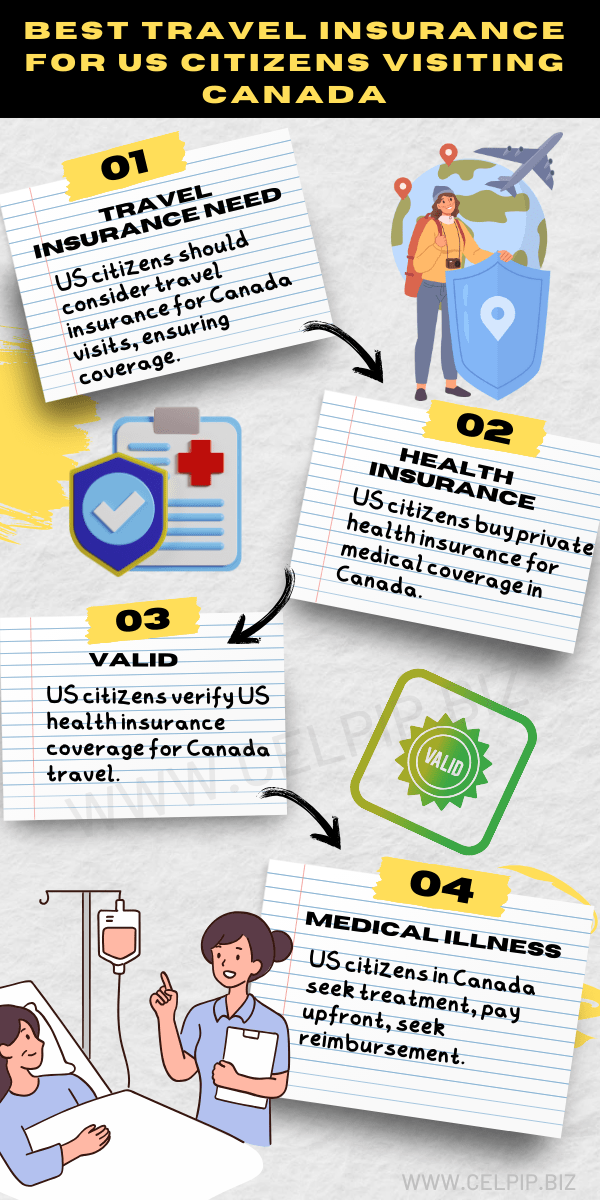

Do US citizens need travel insurance to visit Canada?

Yes. While travel insurance is not mandatory, it is strongly recommended to cover unexpected medical expenses, trip cancellations, and emergencies.

Can US citizens get health insurance in Canada?

US citizens cannot access Canada’s public healthcare system. However, they can purchase private travel or health insurance to cover medical costs during their stay.

Can US health insurance be used in Canada?

Some US health insurance plans may offer limited coverage in Canada. Travellers should check with their insurer before departure to understand what is covered.

What happens if a US citizen gets sick in Canada?

US travellers can receive medical treatment in Canada but may need to pay upfront. Reimbursement depends on their travel insurance or US health insurance coverage.

Final Thoughts

With proper planning, awareness, and comprehensive travel insurance, US citizens can safely enjoy everything Canada has to offer. The right preparation ensures peace of mind, allowing travellers to focus on creating unforgettable memories while exploring Canada’s beauty and diversity.