Car Loan for New Immigrants Canada? Moving to a new country like Canada as an immigrant comes with its own set of challenges, one of which is often the need for reliable transportation.

For many newcomers, owning a car can greatly enhance mobility and ease the transition into a new life. However, navigating the process of obtaining a car loan as a new immigrant can seem daunting.

In this comprehensive guide, we will explore the steps, requirements, and options available to new immigrants in Canada seeking to secure a car loan.

Whether you are a recent arrival or in the midst of settling into your new home, understanding the ins and outs of car financing can make the process smoother and more accessible.

Canada’s vast landscape and diverse cities often require reliable transportation for work, daily activities, and exploring the country’s beauty.

Having a car provides the freedom to travel at your convenience, especially in areas with limited public transportation options.

For new immigrants, owning a car can mean independence, flexibility, and a sense of security in their new surroundings.

Obtaining a car loan in Canada involves understanding the requirements set by lenders, establishing credit history, and choosing the right financing option for your needs.

For new immigrants who may not have a Canadian credit history or established financial background, the process can present unique challenges.

In the following sections, we will delve into the specifics of getting a car loan as a new immigrant in Canada.

From building credit history to exploring lenders who cater to newcomers, we will provide you with valuable insights and actionable steps to help you secure the car financing you need.

The Process to Get Car Loan in Canada as a Newcomer

Obtaining a car loan as a newcomer without an established credit history in Canada is daunting but not impossible. Here’s a step-by-step guide to help you through the process:

1. Establish Your Credit History

a. Get a Canadian Bank Account – The first step in building a credit history in Canada is to open a Canadian bank account. This demonstrates financial stability and provides a platform for managing your finances.

b. Apply for a Credit Card – Securing a Canadian credit card, such as a secured credit card, can help you start building credit. A secured credit card requires a deposit, usually equal to the credit limit, which acts as collateral.

c. Use Credit Responsibly – Once you have a credit card, use it responsibly by making regular payments on time and keeping your credit utilization low. This helps establish a positive credit history.

2. Gather Required Documents

a. Proof of Income – Provide documentation of your income, such as pay stubs, employment letters, or tax returns. This demonstrates to lenders that you have a steady source of income to repay the loan.

b. Proof of Residency – Lenders will require proof of your Canadian residency, which can include a lease agreement, utility bills in your name, or a government-issued ID with your address.

c. Down Payment – Prepare a down payment, which is often required for car loans. The amount can vary but having a larger down payment can improve your chances of approval and may result in better loan terms.

3. Research Lenders and Loan Options

a. Banks and Credit Unions – Canadian banks and credit unions offer car loans to new immigrants. Consider visiting different financial institutions to compare interest rates, loan terms, and eligibility requirements.

b. Dealership Financing – Many car dealerships in Canada offer financing options for new immigrants. While convenient, dealership financing may come with higher interest rates. Compare these rates with other lenders.

c. Alternative Lenders – Explore alternative lenders or online financing platforms that cater to newcomers or individuals with limited credit history. These lenders may have more flexible requirements.

4. Get Pre-Approved

a. Submit Loan Applications – Once you’ve selected potential lenders, submit loan applications. Some lenders allow you to apply online, making the process convenient.

b. Review Loan Offers – Compare the loan offers you receive, including interest rates, loan terms, and any additional fees. Choose the option that best fits your financial situation and budget.

c. Get Pre-Approved – Getting pre-approved for a car loan gives you a clear idea of how much you can borrow and the interest rate you qualify for. This helps streamline the car-buying process.

5. Choose Your Car

a. Determine Your Budget – Consider not only the cost of the car but also ongoing expenses such as insurance, maintenance, and fuel. Choose a car that fits comfortably within your budget.

b. Research Car Models – Research different car models to find one that meets your needs and preferences. Consider factors such as fuel efficiency, safety features, and reliability.

c. Test Drive and Inspect – Before finalizing your purchase, schedule test drives to ensure the car meets your expectations. Also, have a trusted mechanic inspect the vehicle for any issues.

6. Finalize the Loan

a. Provide Documentation – Once you’ve chosen a car, provide the necessary documentation to the lender, including the purchase agreement, insurance information, and proof of registration.

b. Sign the Loan Agreement – Review the loan agreement carefully, paying attention to the interest rate, repayment terms, and any conditions. Sign the agreement once you’re satisfied.

c. Take Delivery of the Car – After completing the loan process, you can take delivery of your new car. Ensure all paperwork is in order, and enjoy the freedom of having your own vehicle.

7. Build and Maintain Good Credit

a. Make Timely Payments – To continue building a positive credit history in Canada, make all loan payments on time. Late payments can negatively impact your credit score.

b. Monitor Your Credit Report – Regularly check your credit report to ensure accuracy and monitor your progress in building credit. Report any discrepancies or errors to the credit bureau.

c. Use Credit Wisely – As you establish credit, use it wisely by maintaining low balances on credit cards and avoiding taking on too much debt. Responsible credit usage will benefit your financial future.

8. Seek Financial Advice

a. Consult with Professionals – If you’re unsure about the loan process or managing your finances, consider seeking advice from financial advisors, immigration consultants, or community organizations.

b. Attend Financial Literacy Workshops – Many organizations offer workshops or seminars on financial literacy tailored to newcomers. Attend these events to gain valuable knowledge and tips.

c. Stay Informed – Keep yourself informed about financial news, credit-building strategies, and resources available to new immigrants. Knowledge is key to making informed financial decisions.

By following these steps and taking a proactive approach to building credit and researching loan options, new immigrants in Canada can successfully secure a car loan.

Remember, each individual’s financial situation is unique, so it’s essential to assess your needs and options carefully before making any decisions.

Conclusion

Navigating the process of securing a car loan as a new immigrant in Canada may seem like a daunting task, but with the right knowledge and preparation, it becomes an achievable goal.

This guide has provided you with a roadmap, from building credit history to choosing the right loan option and finally driving off with your dream car.

As a newcomer to Canada, owning a car can bring a sense of freedom, independence, and convenience in exploring your new home.

By following the steps outlined in this guide, you are not only acquiring a means of transportation but also building a foundation for a strong financial future.

Remember, each step, from establishing credit to making timely payments, plays a crucial role in shaping your credit history and financial well-being.

Stay informed, seek advice when needed, and continue to make wise financial decisions as you embark on this exciting journey.

Good luck!

Frequently Asked Questions (FAQs) on Car Loan for New Immigrants Canada

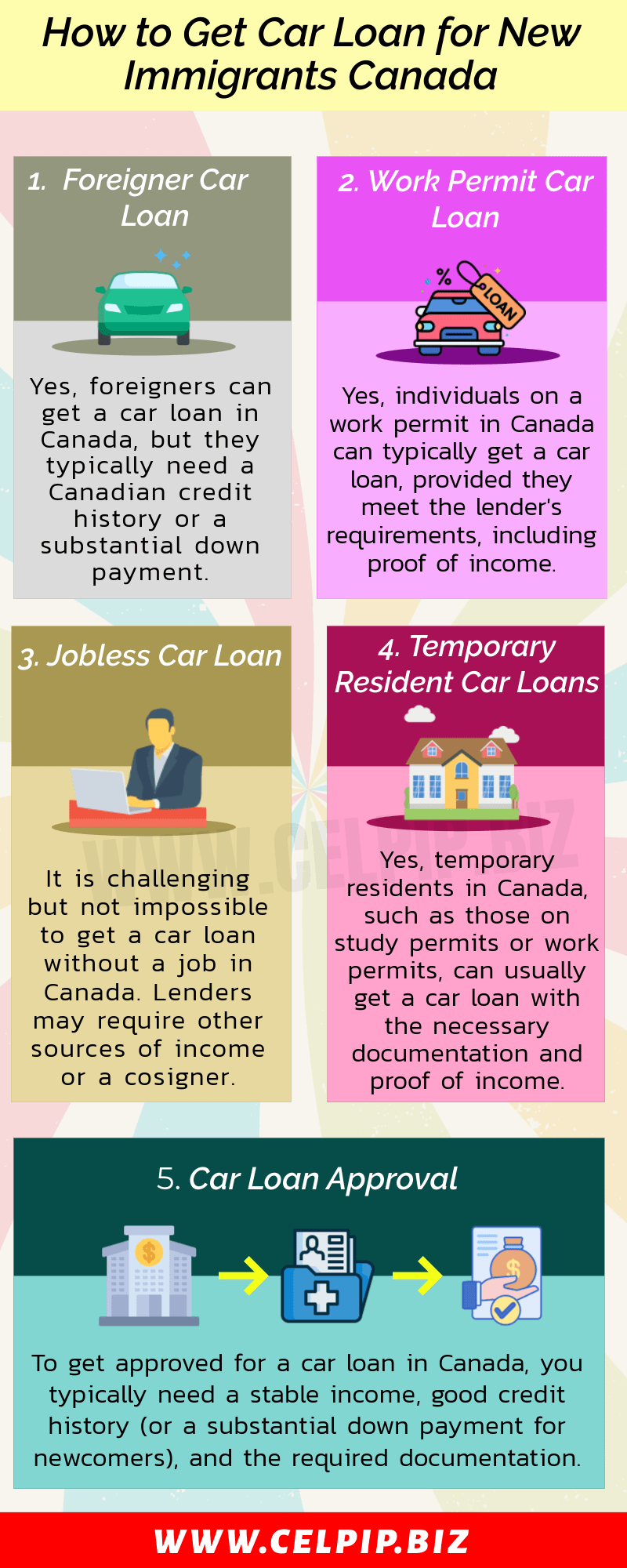

1. Can a foreigner get a car loan in Canada?

Yes, foreigners can get a car loan in Canada, but they typically need a Canadian credit history or a substantial down payment.

2. Can I get a car loan on a work permit in Canada?

Yes, individuals on a work permit in Canada can typically get a car loan, provided they meet the lender’s requirements, including proof of income.

3. Can I get a car loan without a job in Canada?

It is challenging but not impossible to get a car loan without a job in Canada. Lenders may require other sources of income or a cosigner.

4. Can a temporary resident get a car loan in Canada?

Yes, temporary residents in Canada, such as those on study permits or work permits, can usually get a car loan with the necessary documentation and proof of income.

5. How to get approved for a car loan in Canada?

To get approved for a car loan in Canada, you typically need a stable income, good credit history (or a substantial down payment for newcomers), and the required documentation.

6. Can I buy a car with a study permit in Canada?

Yes, individuals with a study permit in Canada can usually buy a car. They can also get a car loan if they meet the lender’s requirements for income and credit history.